Facebook Twitter (X) Instagram Somali Magazine - People's Magazine

Dollar strengthens while Euro wobbles amid talk of postponed US tariffs and expectations of more ECB rate cuts. Market volatility continues as traders watch Fed and ECB moves

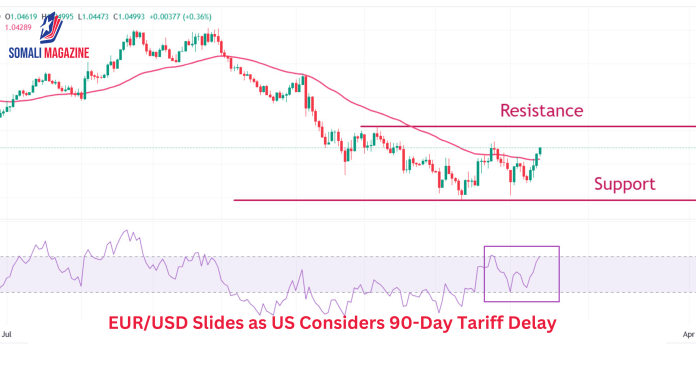

The Euro fell against the US Dollar on Monday, with the EUR/USD pair dipping to around 1.0880 before bouncing back to about 1.0940. Even with the small recovery, the Euro was still down by about 0.25% for the day. The US Dollar strengthened after news broke that the Trump administration might delay new tariffs for most US trading partners, except China, for 90 days.

This possible pause in tariffs was mentioned by Kevin Hassett, head of the US National Economic Council. Though the White House hasn’t officially confirmed it, the move would give other countries time to negotiate deals and possibly avoid the tariffs altogether.

Market analysts say that this delay could help the US economy, which has been under pressure since Trump announced new tariffs last week. The pause shows the administration may be open to easing trade tensions to avoid hurting the economy further.

Market Reaction and Comments from Trump

The announcement of tariffs caused panic in global markets, leading to a drop in stock prices. But President Trump seemed unfazed by this. Speaking aboard Air Force One, he said, “Sometimes you have to take medicine to fix something,” suggesting that the short-term pain is necessary for long-term gain.

Economists, however, have raised concerns that these tariffs could hurt the US more than help it. JP Morgan warned that if the tariffs go into full effect, the US economy might shrink by 0.3% by the end of the year. They argue that American importers and consumers will bear most of the cost.

Trump also used social media to push the Federal Reserve to cut interest rates. He claimed that the US economy is in a good place, with low inflation and falling prices. He wrote that the Fed should take advantage of the current conditions and cut rates.

Federal Reserve Chair Jerome Powell, on the other hand, warned that the trade policies could increase inflation and slow growth. Still, he said it’s too early to make changes to the current interest rate range of 4.25% to 4.50%.

Euro Struggles as ECB Plans More Rate Cuts

The Euro’s weakness is also due to uncertainty in the Eurozone. The European Central Bank (ECB) is expected to cut interest rates again soon. ECB officials don’t believe that US tariffs will cause long-lasting inflation in Europe. Because of that, traders are betting that the ECB will ease policy further.

ECB board member Isabel Schnabel said over the weekend that US tariffs are adding to Europe’s economic challenges. She warned that these trade tensions are creating “a dramatic surge in uncertainty,” which could hurt the Eurozone even more.

The ECB has already cut interest rates twice this year and is expected to do so again on April 17. If that happens, the deposit rate would drop to 2.25%, which is generally bad news for the Euro.

Meanwhile, Eurostat reported that retail sales in February rose by 0.3%, which was less than the 0.5% expected. However, on a yearly basis, sales were up 2.3%, which matched the previous reading.

Technical Outlook and Diplomatic Hopes

On a more positive note, the Euro has found some support near the 10-day Exponential Moving Average (EMA) at around 1.0886. Technical analysts say that this could help the EUR/USD pair hold steady above the key level of 1.0938.

Also, European Union leaders are trying to ease trade tensions with the US. EU Commission President Ursula von der Leyen said they are open to talks with Washington. EU Trade Commissioner Maros Sefcovic added that the EU has even offered to eliminate tariffs on cars and industrial goods if the US does the same.

Overall, while the EUR/USD pair has seen some ups and downs, it’s currently being influenced by US tariff news, Federal Reserve and ECB policies, and ongoing trade negotiations. The pair is still trying to recover after last week’s highs but is supported by key technical levels and hopes of easing trade tensions.