Facebook Twitter (X) Instagram Somali Magazine - People's Magazine

Mogadishu, Somalia – September 9, 2025 – For decades, Somalis traveling abroad navigated their journeys with little more than determination, resourcefulness, and cash hidden in their bags. The collapse of Somalia’s central bank during the civil war left the nation without a functioning financial infrastructure for years. In its place grew an informal network of hawala agents and remittance systems that helped citizens survive, but limited their access to the global economy. Travelers heading to foreign countries often had to rely on relatives overseas, carry large sums of money, or depend on cash-only travel agencies. It was a system fraught with risk, insecurity, and lost opportunities. But that reality is beginning to change. Somalia is in the midst of a quiet financial revolution, with banks such as IBS Bank introducing globally recognized banking cards through partnerships with VISA and Mastercard.

Now, for the first time in decades, Somali citizens can carry cards that work across borders, granting them secure access to payments, ATMs, and online services abroad. For a country that has been financially isolated for years, this is a milestone moment, and one that is already transforming the experiences of students, patients, entrepreneurs, and pilgrims.

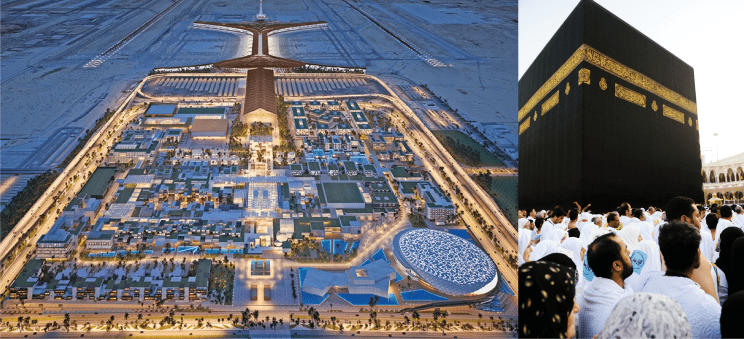

The shift away from cash-based travel is not simply a matter of convenience. It represents Somalia’s reintegration into the global financial system. Students studying in India, Turkey, or Europe can now pay tuition directly and manage living expenses without depending on risky money transfers. Patients traveling to hospitals in Turkey or India for treatment can settle bills securely, book appointments online, and access emergency funds instantly. Businesspeople attending conferences in Dubai or Guangzhou can handle logistics, subscriptions, and travel costs without carrying stacks of dollars. Even pilgrims embarking on Hajj and Umrah can move seamlessly through Makkah and Madinah with cards that enable them to pay for accommodation, transportation, and food without the burden of carrying cash.

Benefits Across Travel Needs

Tourism & Lifestyle: Hotels, restaurants, and retail outlets worldwide now accept Somali-issued cards, reducing the need for cash conversions.

Healthcare Abroad: Patients traveling to Turkey or India can pay hospitals and clinics directly, while premium cards extend insurance and medical assistance services.

Business Travel: Professionals enjoy secure online transactions, expense tracking, and perks like airport lounge access with premium VISA Infinite or World Elite Mastercard cards.

Education: Students in India, Malaysia, and Europe can use cards for tuition, accommodation, and online educational subscriptions, while families send support instantly.

Pilgrimage: For Hajj and Umrah, cards enable cashless payments across Makkah, Madinah, and Jeddah, plus ATM withdrawals in Saudi Riyals.

The benefits extend further with premium cards such as VISA Infinite and World Elite Mastercard. These services bring with them airport lounge access, concierge booking support, travel insurance, and emergency medical assistance – features that offer Somali travelers not just comfort, but safety and efficiency. For a country rebuilding its place in the global economy, these services elevate the travel experience and make Somalis competitive in a world where mobility and financial access often go hand in hand.

IBS Bank Leading the Way

At the center of this transformation is IBS Bank. The Mogadishu-based institution has already made history by being the first in Somalia to provide international remittances through Western Union and Ria. Now, with instant issuance of globally accepted banking cards nationwide, IBS is bridging Somalia’s citizens with the broader world. The ability to obtain a card within hours, rather than weeks or months, is a leap forward in accessibility and signals the bank’s role as a pioneer in modern Somali banking.

This is more than an economic upgrade; it is a matter of dignity and security. Modern cards come with fraud protection, real-time spending alerts, and emergency replacement services, giving Somali travelers a level of financial control they never had before. The confidence to walk into a hotel in Istanbul or a store in Kuala Lumpur and pay like any other traveler is a small act with enormous symbolic weight. It marks Somalia’s gradual return to normalcy in the eyes of the international financial community.

Challenges remain, of course. Somalia is still working to rebuild trust in its financial institutions after decades of instability. Informal systems like hawala remain dominant in everyday life, and widespread adoption of modern banking may take time. Yet the progress is undeniable. Every Somali student who pays tuition with a card, every businessperson who books services abroad without fear of theft, every patient who can focus on treatment instead of financial logistics – all are signs of a country reclaiming its place in the global system.

In many ways, banking cards are a symbol of Somalia’s resilience. They show how a nation once excluded from the world’s financial systems is now finding ways to reconnect, not through aid, but through integration. For Somali travelers, they are no longer simply passengers moving with cash in their pockets. They are participants in a global economy, carrying with them tools that bring safety, efficiency, and recognition. And for Somalia itself, each card represents another step toward stability, confidence, and belonging on the international stage.