Facebook Twitter (X) Instagram Somali Magazine - People's Magazine

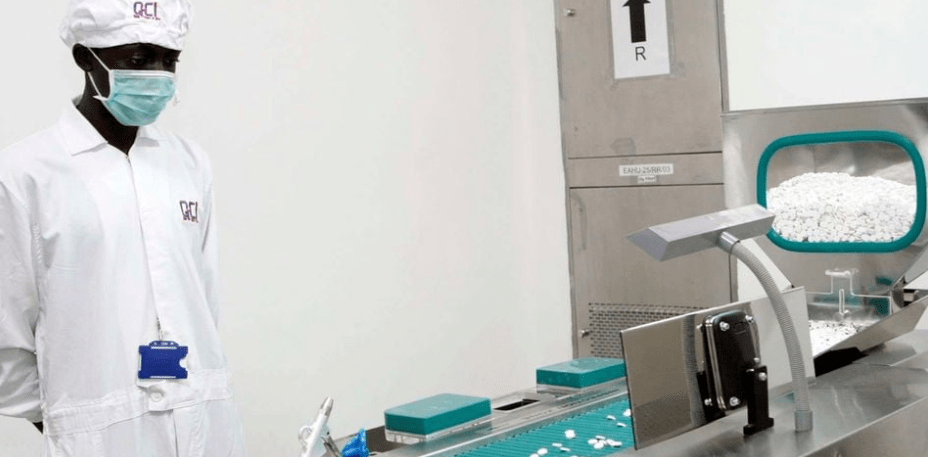

Uganda’s Quality Chemicals proposes $51M debt refinancing deal, aiming to restructure its financial obligations and unlock new capital for expansion in East Africa’s pharmaceutical sector. The proposal, submitted to lenders and stakeholders this week, outlines a strategic plan to refinance existing debt and inject fresh liquidity into operations, positioning the company for long-term sustainability and regional competitiveness.

Quality Chemicals, one of Uganda’s leading pharmaceutical manufacturers, has faced mounting financial pressure amid rising production costs, currency volatility, and delayed payments from public health contracts. The $51 million refinancing package is designed to ease short-term debt burdens, extend repayment timelines, and support the company’s goal of scaling up production of essential medicines, including antiretrovirals and anti-malarials.

According to sources familiar with the deal, the company is negotiating with a consortium of local and international lenders, including commercial banks and development finance institutions. The refinancing plan includes a mix of debt restructuring, equity injection, and performance-based incentives tied to production targets and export growth.

Quality Chemicals CEO Emmanuel Katongole said the proposal reflects the company’s commitment to innovation, resilience, and regional health security. “This refinancing deal is not just about balance sheets—it’s about building a stronger pharmaceutical backbone for Uganda and the region,” he stated. “We are confident that with the right financial structure, we can meet growing demand and expand our footprint across Africa.”

The company’s financial challenges mirror broader trends in Uganda’s industrial sector, where access to affordable credit remains a key constraint. Uganda’s 2025/26 national budget prioritizes industrialization and value addition, but private sector players continue to grapple with high interest rates and limited long-term financing options.

Quality Chemicals has played a pivotal role in Uganda’s health sector, supplying life-saving drugs to government hospitals and international aid programs. Its partnership with Cipla, a global pharmaceutical giant, has enabled technology transfer and local manufacturing of high-quality generics. However, delays in government payments and foreign exchange losses have strained cash flow, prompting the need for refinancing.

Industry analysts say the proposed deal could set a precedent for other manufacturers seeking to navigate post-pandemic economic headwinds. “This is a bold move that signals confidence in Uganda’s pharmaceutical potential,” said Dr. Sarah Nambatya, a health economist. “If successful, it could catalyze investment and improve access to medicines across the region.”

The refinancing proposal also aligns with Uganda’s broader economic goals, including reducing reliance on imported drugs and promoting local production. The Ministry of Health has endorsed efforts to strengthen domestic pharmaceutical capacity, citing the need for supply chain resilience and job creation.

Stakeholders are expected to review the proposal over the coming weeks, with final decisions anticipated by the end of the third quarter. If approved, the deal could unlock new opportunities for Quality Chemicals, including expansion into new markets, product diversification, and enhanced research and development.

As Uganda positions itself as a regional pharmaceutical hub, the success of this refinancing initiative could mark a turning point—not just for Quality Chemicals, but for the future of African health manufacturing.