Mogadishu

Somali Magaizne –

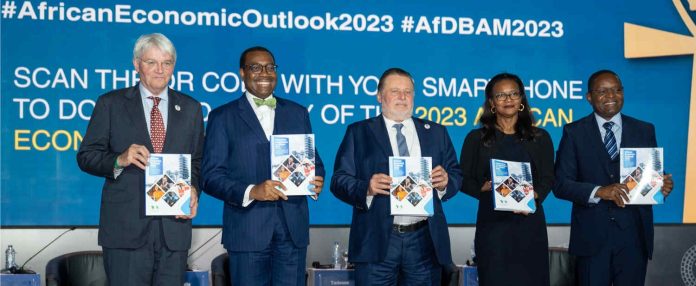

A new economic outlook report for 2023 released by the African Development Bank (AfDB) reveals that numerous shocks have slowed Africa’s economic growth.

Among them high inflation, depreciating of local currencies against the US dollar and supply chain bottlenecks.

These hurdles created contributed to a low growth of Gross Domestic Product (GDP) to stand at 3.8 % in 2022. This was a reduction from the 4.8 per cent reported by African economies in 2021.

However, AfDB reports that the continent’s average GDP growth last year was more than the global average of 3.4 percent. In fact, all but two African countries recorded positive growth trends. Overall, African nations have shown remarkable resilience, which is evident in the projected economic growth that surpasses the global average.

“The outlook remains positive and stable, with a projected rebound to 4 per cent in 2023 and further consolidation to 4.3 per cent in 2024. Our projections show that 18 African countries will experience growth rates exceeding 5 per cent in 2023, a number expected to increase to 22 in 2024,” states the World Bank in its 2023 Economic Outlook report for Africa.

According to the report, Africa’s resilience will be further reinforced by the anticipated improvements in general global economic conditions. A key factor in this global improvement is China’s resurgence and trade post Covid-19 pandemic.

The multilateral lender is however cautious, noting that, “the projected rebound in growth will depend on underlying economic characteristics.” Some of these characteristics include growth in oil-exporting countries attributable to better oil prices. Similarly, non-resource-intensive economies are expected to gain from their diverse economic structures.

“The tightening of global financial conditions and appreciation of the US dollar have exacerbated debt service costs and could increase the risk of debt distress, especially for countries with severely constrained fiscal positions.”

The continental lender also pointed out that the prolonged Russian invasion of Ukraine as a major global risk that is hurting Africa’s performance. Then there is climate change, which again the AfDB says continues to threaten lives, livelihoods, and economic activities.

The UN estimates that there is a $1.3 trillion financing gap that is necessary to achieve Sustainable Development Goals (SDGs). This figure highlights the huge magnitude of Africa’s sustainable development financing requirements.

The AfDB makes a strong case for private sector financing, citing factors like identifying investment opportunities across different sectors. It also singles out a number of barriers and risks to attract private investments in climate and green growth. What’s more, the lender discusses innovative financing instruments, and policy and regulatory instruments to attract private sector financing.